Pushpa Nakshatra:If you are planning to buy gold, then keep these 5 things in mind including hallmarking and gold price

If you are planning to buy gold, then keep these 5 things in mind including hallmarking and gold price

Today is Pushya Nakshatra, next 10 days are Dhanteras and Diwali. This is the time when buying gold is considered auspicious. At present, the prices are also below the record level by about Rs 8,500 per ten grams. In this sense also this is a good opportunity to buy gold. If you are also planning to buy gold on this occasion, then Prithviraj Kothari, National President of India Bullion and Jewelers Association is telling about the precautions, by adopting which your gold will become even more gold.

Buy

only hallmarked jewelry Buy only hallmarked jewelry. Although hallmarking of gold jewelery is mandatory, it is exempted for jewelers whose annual turnover is less than Rs 40 lakh. The good thing is that customers can even ask for hallmarked jewelery from such jewellers. The purity of such jewelry is assured. This means if you have bought 22-carat jewelry then hallmark will guarantee that the purity of the gold will not be less than 91.6%.

Negotiation on the making of jewelry Know the price of

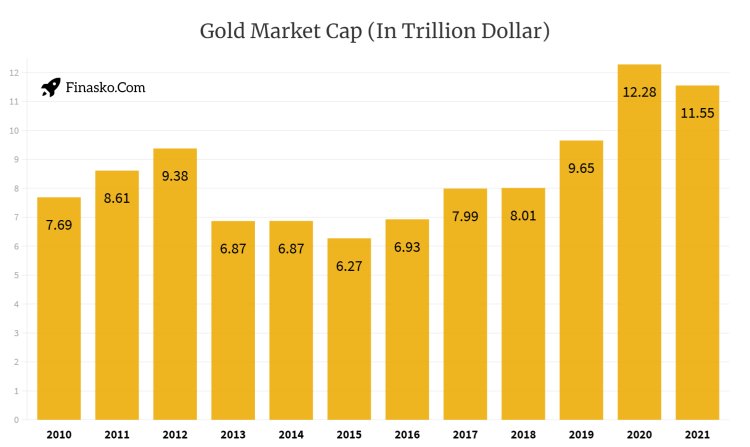

gold If you are waiting for the price of gold to come down, then you can remain in loss, as the prices may increase instead of falling. You can take the opinion of some jewelers on this matter. Apart from this, one can also visit the website of the India Bullion and Jewelers Association (IBJA) to see the exact price of gold. By doing this, you will avoid unintentionally buying expensive jewelry.

If you are buying gold jewelry then the making charge becomes important. There is a lot of scope for bargaining here. You can ask the jeweler to reduce the making charges. Jewelry can be 10-30% of the made price. So if you manage to reduce it, there can be huge savings. You can also compare the making charges of different jewelery houses.

Make sure to check the correct weight of the jewelry,

gold is very expensive. So even a few grams difference in weight can make a big difference in the price of the jewelry. The bill matters a lot in this case. The weight of the jewelry is written on it. If you think the actual weight of the jewelry is less, then you can get it weighed at a place other than the jeweller. In case of weight loss, you can claim with the jewelers along with the bill.

Don't forget to collect the bill from the jeweler Don't forget to

collect the bill from the jewellers. If you want to sell your gold at a profit after a few years, you will need to look at its purchase price to know how much it is profitable. Not only this, if any dispute arises with the jeweler on issues like price, purity, and making charges, you can show the bill to him for your claim. Apart from this, this document can also be useful in the case of income tax.

The seventh installment of the Investment Alert Sovereign Gold Bond Scheme is opening for subscription from Monday. This option of investing in gold will remain open till October 29. Gold bonds will be issued to investors on November 2. This time the Reserve Bank has fixed its price at Rs 4,765 per gram. 50 per gram discount will be available on online payment. It also earns 2.5% interest annually.